Dangers of House Collateral Finance and ways to Avoid them

Kristy try a freelance factor to Newsweek’s private loans team. Due to the fact a publisher, Kristy has worked with websites for example Bankrate, JPMorgan Pursue and NextAdvisor so you’re able to hobby and you can sharpen articles into the financial, handmade cards and you will financing. She actually is and written to have e-books eg Forbes Coach and U.S. Development and you can World. In her time, Kristy wants travel, hitting-up rail tracks and you will understanding.

Ashley are an associate publisher during the Newsweek, with knowledge of individual lending. This woman is excited about creating by far the most accessible individual funds articles for everybody subscribers. Prior to Newsweek, Ashley spent nearly 36 months within Bankrate just like the a publisher covering handmade cards, devoted to transactional posts together with subprime and student borrowing.

If you’re looking having an effective way to score more cash, you are given a house security mortgage. Taking out property guarantee loan enables you to obtain out-of the fresh equity you have built in your home. not, domestic collateral money possess several threats to adopt-like the possibility of losing your home. Know how to prevent family collateral loan dangers so you can build an audio credit decision.

Our very own research is built to offer you an extensive understanding out of private money goods that work best with your position. So you’re able to about decision-while making procedure, the professional contributors examine well-known preferences and you may possible serious pain points, eg affordability, access to, and you can dependability.

Vault’s Viewpoint

- When taking away property security loan, your home is at stake as the security.

- If for example the value of your residence alter rather, you may find oneself under water in your home loan.

- Taking out property collateral financing could also damage your credit get when you yourself have an excessive amount of debt.

What is actually a house Security Financing as well as how Will it Works?

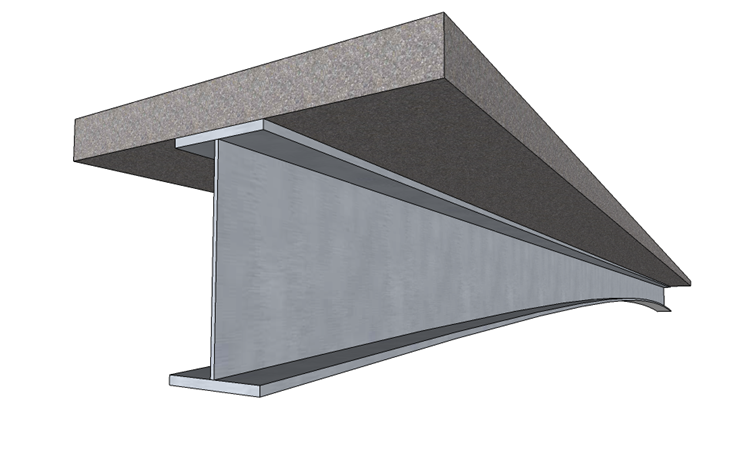

A house guarantee financing is where you obtain throughout the guarantee you’ve produced in your home. Security is dependent on the house’s latest ount you will still owe on your own mortgage. Because you pay-off your home loan, you should create a lot more about security where you could acquire.

You will need to apply with a lender to take out a great home guarantee financing. Generally speaking, financial institutions only let you acquire around 85% of the security you may have of your home. Such as for example, for those who have a home worth $eight hundred,000 but still owe $300,000 in your mortgage, you have $100,000 during the collateral. Who would help make your maximum family collateral amount borrowed $85,000.

The big Type of Threats Regarding the House Guarantee Fund

There is a lot to take on prior to taking aside a property collateral financing. Here are a few of one’s bad family collateral mortgage dangers in order to remember prior to committing.

Dropping Your residence

Which have a house equity mortgage, your home is collateral. If you standard for the loan, the financial contains the to foreclose into property.

This task would not occurs once that skipped payment, it may seem if you fail to pay for numerous days consecutively. Your own bank wouldn’t jump right to providing your home-they may is actually a profile company or municipal lawsuits very first. But if these types of falter, you might lose your house.

Going Underwater on your own Financial

Average home purchases rates nationwide attained number levels for the one-fourth four off 2022, according to the Federal Set-aside Bank. But since that time, they have gone down, deciding to make the residents at risk of heading under water to their mortgage loans. Are under water to your a mortgage happens when you borrowed from more funds than simply http://www.paydayloanflorida.net/north-port you reside really worth. This example is difficult should you want to promote your home as you won’t make adequate to pay off their mortgage.